SBI Recruitment Risk Specialists starts from 18th Sept 2020. Risk Specialists opportunity is available across various sectors in SBI. The sectors that risk specialists can apply to include

Power-1, Hydrocarbon & Petrochemicals-1, EPC/Construction & Roads-1, Real Estate-1, Large accounts/ Key Group Analyst-1.In addition to the aforementioned sectors, there are also other sectors that risk specialists in scale II can apply. The sectors are Automobiles & Auto components-1, Textiles-1, Food processing-1, Precious metals, Gems & Jewellery-1, Service industries like Hospitality, Hospitals, Education, IT etc.-1.The last date to apply for SBI Recruitment Risk Specialists 2020 is 8th Oct 2020.

Important Dates

Online Registration Date:18th Sept 2020

Last date to register: 8th Oct 2020

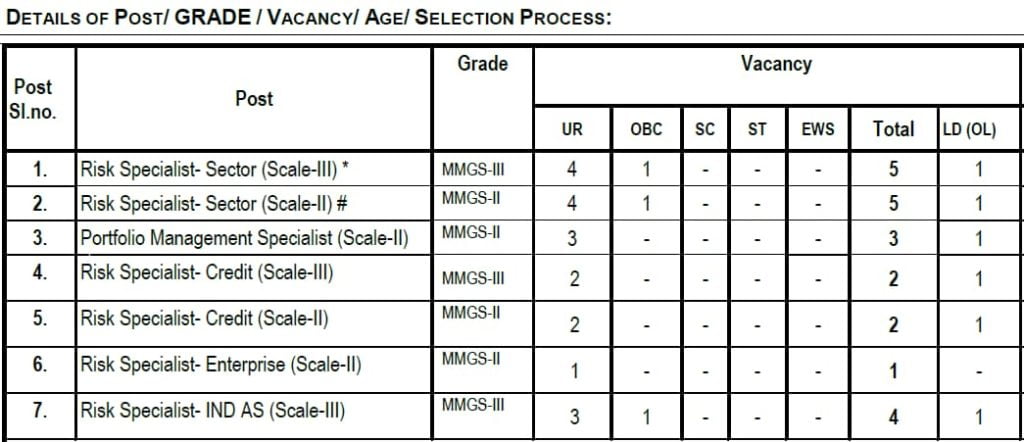

SBI Recruitment Risk Specialists Vacancy

SBI Recruitment Risk Specialists Eligibility Criteria

(1)Post: Risk Specialist- Sector (Scale-III)

Age (as on 01.04.2020):

Min 25 years

Max 30 years

Educational Qualification:

Basic Qualifications:

(i) Chartered Accountant (CA), or

(ii) CFA, or

(iii) MBA/PGDM (Finance/ Data Analytics/ Business Analytics) or its equivalent as full-time course from recognised institute, or

(iv) M.Sc. (Statistics)

Other qualification (Preferred):

Financial Risk Manager (FRM) by GARP

Profession Risk Managers by PRMIA

PGDBM from NIBM

Post Qualification Experience:

4 Years’ Post qualification Experience in Financial Institutions/ Rating Agencies/ Brokerage Firms with domain knowledge across sector/ industry, experience in primary/ secondary research, experience in risk modelling, data analysis, report writing, etc. in any of the following Sectors:

a. Power

b. Hydrocarbon & Petrochemicals

c. EPC & Roads

d. Real Estate

e. Large Accounts / Key Group Analyst

Specific skills Desired:

- Excellent Communication Skills (verbal as well as written).

- Problem Solving Aptitude.

- Analytical Thinking.

- Experience in working on applications like Python, R, SPSS, SAS, etc.

- Proficiency in MS Office applications, especially in MS Excel.

Likely Place of Posting: Mumbai

Responsibilities & Functions:

i. Industry Research and Large Account Reports

- Conduct historical performance analysis quantitatively and qualitatively (trends, disruptions, etc.).

- Actively monitor developments in the sector to update the financial model assumptions and update forward looking macro sectoral views of the bank and key large accounts outlook.

- Ensure creation of reports within target TAT and with minimum errors.

- Liaise with Sector credit specialists within Credit Review department to discuss important sector level updates and exchange feedback on key observations.

(2)Post: Risk Specialist- Sector (Scale-II)

Age (as on 01.04.2020):

Min 25 years

Max 30 years

Educational Qualification:

Basic Qualifications:

(i) Chartered Accountant (CA), or

(ii) CFA, or

(iii) MBA/PGDM (Finance/ Data Analytics/ Business Analytics) from recognised institute, or

(iv) M.Sc. (Statistics)

Other qualification (Preferred):

Financial Risk Manager (FRM) by GARP

Profession Risk Managers by PRMIA

PGDBM from NIBM

Post Qualification Experience:

2 Years’ Post qualification Experience in Financial Institutions/ Rating Agencies/ Brokerage Firms with domain knowledge across sector/ industry, experience in primary/ secondary research, experience in risk modelling, data analysis, report writing, etc. in any of the following Sectors:

a. Automobiles & Auto Components

b. Textiles

c. Food processing

d. Precious Metals, Gems & Jewellery

e. Service Industries, like Telecom, IT, Hospitality, Hospitals, Education, etc.

Specific skills Desired:

- Excellent Communication Skills (verbal as well as written).

- Problem Solving Aptitude.

- Analytical Thinking.

- Experience in working on applications like Python, R, SPSS, SAS, etc.

- Proficiency in MS Office applications, especially in MS Excel.

Likely Place of Posting: Mumbai

Responsibilities & Functions:

i. Industry Research and Large Account Reports

- Conduct historical performance analysis quantitatively and qualitatively (trends, disruptions, etc.).

- Actively monitor developments in the sector to update the financial model assumptions and update forward looking macro sectoral views of the bank and key large accounts outlook.

- Ensure creation of reports within target TAT and with minimum errors.

- Liaise with Sector credit specialists within Credit Review department to discuss important sector level updates and exchange feedback on key observations.

(3)Post: Portfolio Management Specialist (Scale-II)

Age (as on 01.04.2020):

Min 25 years

Max 30 years

Educational Qualification:

Basic Qualifications:

(i) Chartered Accountant (CA), or

(ii) CFA, or

(iii) MBA/PGDM (Finance/ Data Analytics/ Business Analytics) from recognised institute, or

(iv) M.Sc. (Statistics)

Other qualification (Preferred):

Financial Risk Manager (FRM) by GARP

Profession Risk Managers by PRMIA

PGDBM from NIBM

Post Qualification Experience:

2 Years’ Post qualification experience in Portfolio Management in Banks/ Financial Institutions for optimum return.

Specific skills Desired:

- Excellent Communication Skills (verbal as well as written).

- Problem Solving Aptitude.

- Analytical Thinking.

- Experience in working on applications like Python, R, SPSS, SAS, etc.

- Proficiency in MS Office applications, especially in MS Excel.

Likely Place of Posting: Mumbai

Responsibilities & Functions:

Responsible for:

*Proactively track the portfolio against defined targets and facilitate the secondary sale of loans by identifying and pricing the loans to be sold.

Responsibilities & Functions:

i. Portfolio Monitoring and Optimization

- Monitor portfolio for credit quality, profitability, risk and other guardrails (concentration, capital, etc.).

- Evaluate industry trends, conditions of clients and prospects to properly position portfolio.

- Conduct periodic analysis of corporate book and identify potential opportunities and challenges.

- Program manage key initiatives identified by senior management towards portfolio optimisation.

- Liaise with multiple functions to drive portfolio objectives/strategy.

- Construct sensitized forward looking projection models to aid business decisions making processes.

- Build real time portfolio measurement tool to aid business decision process.

ii. Portfolio Reporting

- Prepare regular reports on performance, profitability and quality of the portfolio.

(4)Post:Risk Specialist- Credit (Scale-III)

Age (as on 01.04.2020):

Min 25 years

Max 30 years

Educational Qualification:

Basic Qualifications:

(i) Chartered Accountant (CA), or

(ii) CFA, or

(iii) MBA/PGDM (Finance/ Data Analytics/ Business Analytics) or its equivalent as full-time course from recognised institute, or

(iv) M.Sc. (Statistics)

Other qualification (Preferred):

Financial Risk Manager (FRM) by GARP

Profession Risk Managers by PRMIA

PGDBM from NIBM

Post Qualification Experience:

4 Years’ relevant post qualification Risk related work experience in Credit risk and risk modelling in Financial Institutions/ Rating Agencies/ Brokerage Firms.

Specific skills Desired:

- Excellent Communication Skills (verbal as well as written).

- Problem Solving Aptitude.

- Analytical Thinking.

- Experience in working on applications like Python, R, SPSS, SAS, etc.

- Proficiency in MS Office applications, especially in MS Excel.

Likely Place of Posting: Mumbai

Responsibilities & Functions :

- Monitoring the credit portfolio in terms of limits on concentration in quality, Geography, industry, product, maturity and large exposure aggregates.

- Ensuring that adequate policies & systems are in place for identifying, measuring, mitigating, monitoring and controlling of Credit Risk in respect of Bank’s credit.

- To evolve Credit Risk Assessment (CRA)/ scoring models for various groups of borrowers.

- The Risk Specialist must carry out Risk Components viz Probability of Default (PD), Loss Given Default (LGD) and Exposure At Default (EAD).

- He must arrange for periodic review of credit risk related policies and dissemination of information.

- Rsik Specialist has to analyse the credit portfolio of the Bank on various defined parameters.

- He must identify and assess risk factors / concentrations and recommend remedial action.

- His responsibility includes computation of Credit Risk Premium (CRP) and advising the same to CPPD/ Business Groups for deciding interest rates.

- Model Development, Review of Models, Rating transition study.

- IRB project (Data collection from operating units, conducting workshops for Risk Raters, Coordinating with EDW for loading data in RDM and capital computation).

(5)Post: Risk Specialist- Credit (Scale-II)

Age (as on 01.04.2020):

Min 25 years

Max 30 years

Educational Qualification:

Basic Qualifications:

(i) Chartered Accountant (CA), or

(ii) CFA, or

(iii) MBA/PGDM (Finance/ Data Analytics/ Business Analytics) from recognised institute, or

(iv) M.Sc. (Statistics)

Other qualification (Preferred):

Financial Risk Manager (FRM) by GARP

Profession Risk Managers by PRMIA

PGDBM from NIBM

Post Qualification Experience:

2 Years’ relevant post qualification Risk related work experience in Credit risk and risk modelling in Financial Institutions/ Rating Agencies/ Brokerage Firms.

Specific skills Desired:

*Excellent Communication Skills (verbal as well as written)

*Problem Solving Aptitude

*Analytical Thinking

*Experience in working on applications like Python, R, SPSS, SAS, etc.

*Proficiency in MS Office applications, especially in MS Excel.

Likely Place of Posting: Mumbai

Responsibilities & Functions :

- Monitoring the credit portfolio in terms of limits on concentration in quality, Geography, industry, product, maturity and large exposure aggregates.

- Ensuring that adequate policies & systems are in place for identifying, measuring, mitigating, monitoring and controlling of Credit Risk in respect of Bank’s credit.

- To evolve Credit Risk Assessment (CRA)/ scoring models for various groups of borrowers.

- The Risk specialist must carry out Risk Components viz Probability of Default (PD), Loss Given Default (LGD) and Exposure At Default (EAD).

- He must arrange for periodic review of credit risk related policies and dissemination of information.

- Risk Specialist has to analyse the credit portfolio of the Bank on various defined parameters.

- He must identify and assess risk factors / concentrations and recommend remedial action.

- His responsibility also involves to compute Credit Risk Premium (CRP) and advising the same to CPPD/ Business Groups for deciding interest rates.

- Model Development, Review of Models, Rating transition study.

- IRB project (Data collection from operating units, conducting workshops for Risk Raters, Coordinating with EDW for loading data in RDM and capital computation).

(6)Post: Risk Specialist- Enterprise (Scale-II)

Age (as on 01.04.2020):

Min 25 years

Max 30 years

Educational Qualification:

Basic Qualifications:

(i) Chartered Accountant (CA), or

(ii) CFA, or

(iii) MBA/PGDM (Finance/ Data Analytics/ Business Analytics) from recognised institute, or

(iv) M.Sc. (Statistics)

Other qualification (Preferred):

- Financial Risk Manager (FRM) by GARP.

- Profession Risk Managers by PRMIA.

- PGDBM from NIBM

Post Qualification Experience:

2 Years’ relevant post qualification Risk related work experience in Enterprise risk and risk modelling in Financial Institutions/ Rating Agencies/ Brokerage Firms.

Specific skills Desired:

*Excellent Communication Skills (verbal as well as written)

*Problem Solving Aptitude

*Analytical Thinking

*Experience in working on applications like Python, R, SPSS, SAS, etc.

*Proficiency in MS Office applications, especially in MS Excel.

Likely Place of Posting: Mumbai

Responsibilities & Functions :

*Effective identification, assessment, monitoring and reporting of risk parameters across SBI and Group entities to top Management

*Review of the enterprise wide Risk Appetite Framework of the Bank and cascading it to the BU’s and quarterly monitoring

*Developing a risk management framework and ICAAP document formulation for RRBs and bringing them under the ambit of the GRM Policy in a calibrated manner

*Development of Risk Culture framework for the Bank and assessment of the same. Develop suitable intervention (BU/Group wise) wherever culture assessed as weak

*Efficient steering and implementation of the Group Risk Transformation Project

(7)Post: Risk Specialist- IND AS (Scale-III)

Age (as on 01.04.2020):

Min 25 years

Max 30 years

Educational Qualification:

Basic Qualifications:

(i) Chartered Accountant (CA), or

(ii) CFA, or

(iii) MBA/PGDM (Finance/ Data Analytics/ Business Analytics) or its equivalent as full-time course from recognised institute, or

(iv) M.Sc. (Statistics)

Other qualification (Preferred):

Financial Risk Manager (FRM) by GARP

Profession Risk Managers by PRMIA

PGDBM from NIBM

Post Qualification Experience:

4 Years’ relevant post qualification Risk related work experience in Credit risk and risk modelling in Financial Institutions/ Rating Agencies/ brokerage Firms.

Specific skills Desired:

*Excellent Communication Skills (verbal as well as written)

*Problem Solving Aptitude

*Analytical Thinking

*Experience in working on applications like Python, R, SPSS, SAS, etc.

*Proficiency in MS Office applications, especially in MS Excel.

Likely Place of Posting: Mumbai

Responsibilities & Functions :

- Defining significant increase in Credit Risk(SICR).

- Incorporating forward looking macro-economic factors in PD, LGD and EAD models.

- Calculation of PIT PD and Lifetime PD for the entire loan portfolio.

- Long run average Loss Given Default for the entire loan portfolio.

- Monitoring of PD, LGD and EAD models on a quarterly basis.

- Validation of all the above models, redevelopment/ recalibration of the models based on validation results.

- Incorporation of process note on ECL methodology for investments as per IND-AS and monitoring of ECL model on regular basis.

- Defining , effective interest rate(EIR) and the process to be adopted for the investment in the valuation manual.

How to Apply?

Below is a step by step guide to apply for SBI Recruitment Risk Specialists.

SBI Login

1.Go to official SBI website https://www.sbi.co.in/careers

2.Then, click on Current Openings.

3.In the Current Openings page check for the post that you want to apply.

4.You will see 2 links-Download Advertisement and Apply Online.

5.Click on Download advertisement to know more details of the post. If you are interested in that post then click on Apply Online to apply directly.

6.You will see 2 options LOGIN if already Registered or Click for New Registration. Click on New Registration.

7.You will see 6 tabs such as Basic info, Details, Qualification, Uploads, Preview and Payment.Enter the necessary details in all the tabs.

8.Click on Register to register yourself.

9.On successful registration, system generates registration number and password.The sane is also sent to your email id.

10.Use your registration details to login to SBI.

Download Official SBI Recruitment Risk Specialists 2020 Notification